Home

About UsProducts & Services

Clarity in the China Markets

FUNDS

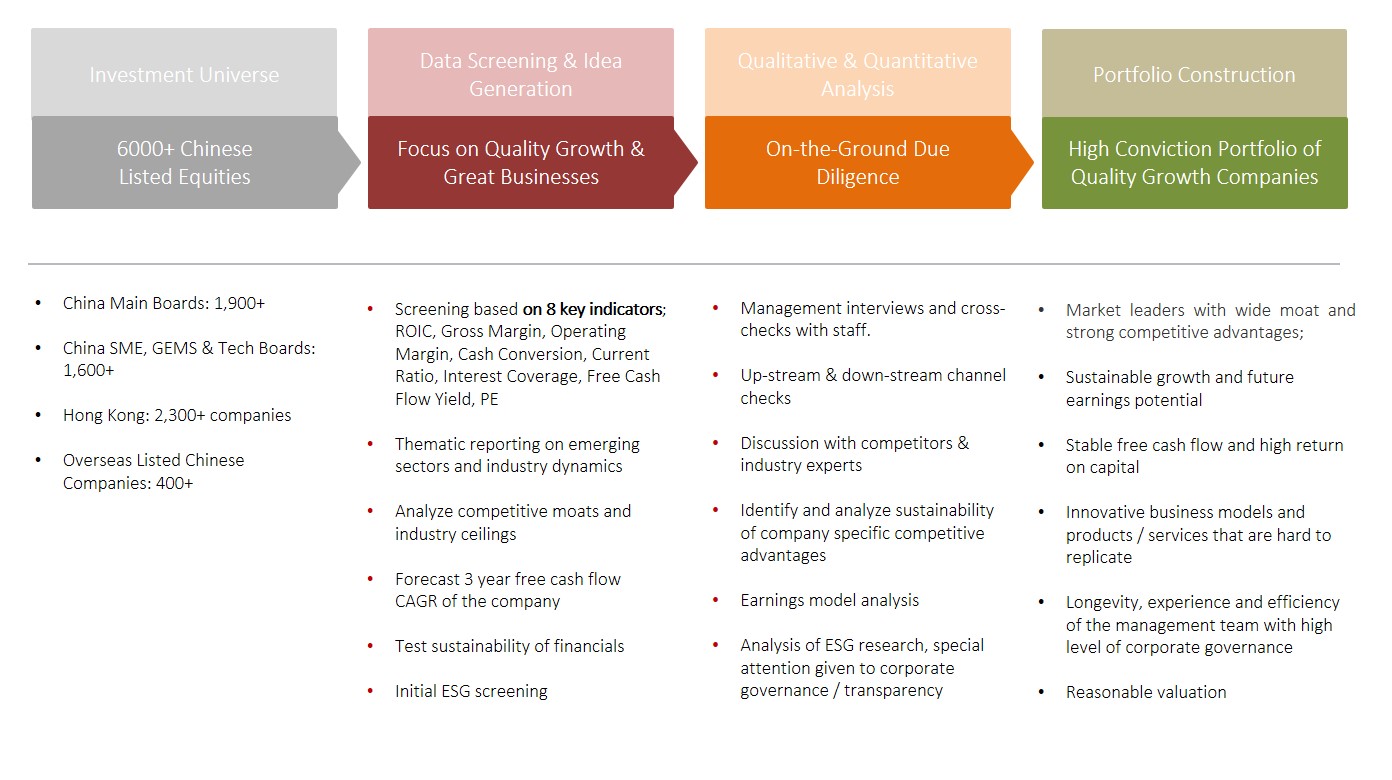

We offer offshore funds investing on the Greater China markets. Please get in touch if you would like to learn more on the Funds under management.

SEPERATELY MANAGED ACCOUNTS

Separately managed accounts (SMAs) offer investors an actively managed private portfolio of Chinese listed companies. We are privileged to work with some of the world’s most prestigious institutional investors in the management of their China mandates.

We manage both Greater China and pure China A-share SMAs utilizing the Shanghai & Shenzhen-Hong Kong Stock Connect, QFI and RQFII programs, We welcome the opportunity to work together with like-minded investors who share our long-term view on the China markets. Please contact us here for more details.

Red Gate Insights

August 4, 2020

August 4, 2020Meeting of the Political Bureau of the Central Committee of the CPC on 30th July 2020: What was said and what does it mean to us?

April 20, 2020

April 20, 2020Red Gate Asset Management – FAQs

April 16, 2020

April 16, 2020Red Gate’s Chingxiao Shao discusses the benefits of being an on-the-ground manager in NBIM’s first virtual seminar

Contact

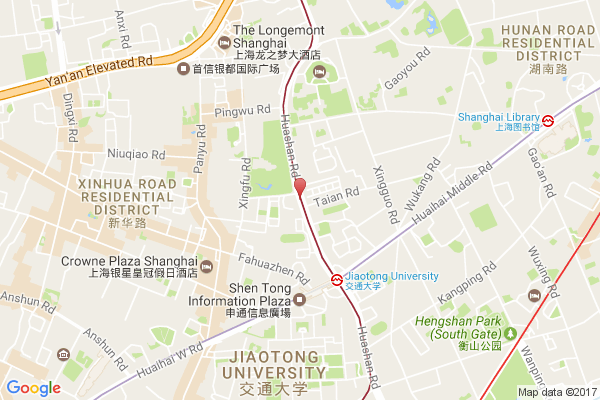

Shanghai

- info@redgateam.com

- Tel: +86-21-6433 8166 Fax: +86-21-6433 8684

- Red Gate Asset Management (Shanghai) Co. Ltd.

Unit 1001, Nan Fung Tower, 1568 Huashan Road,

Shanghai 200052

People’s Republic of China

Hong Kong

- info@redgateam.com

- Tel: +852-3956 1331 Fax: +852-3956 9028

- Red Gate Asset Management Co. Ltd

1504 New World Tower I

18 Queen’s Road Central

Hong Kong